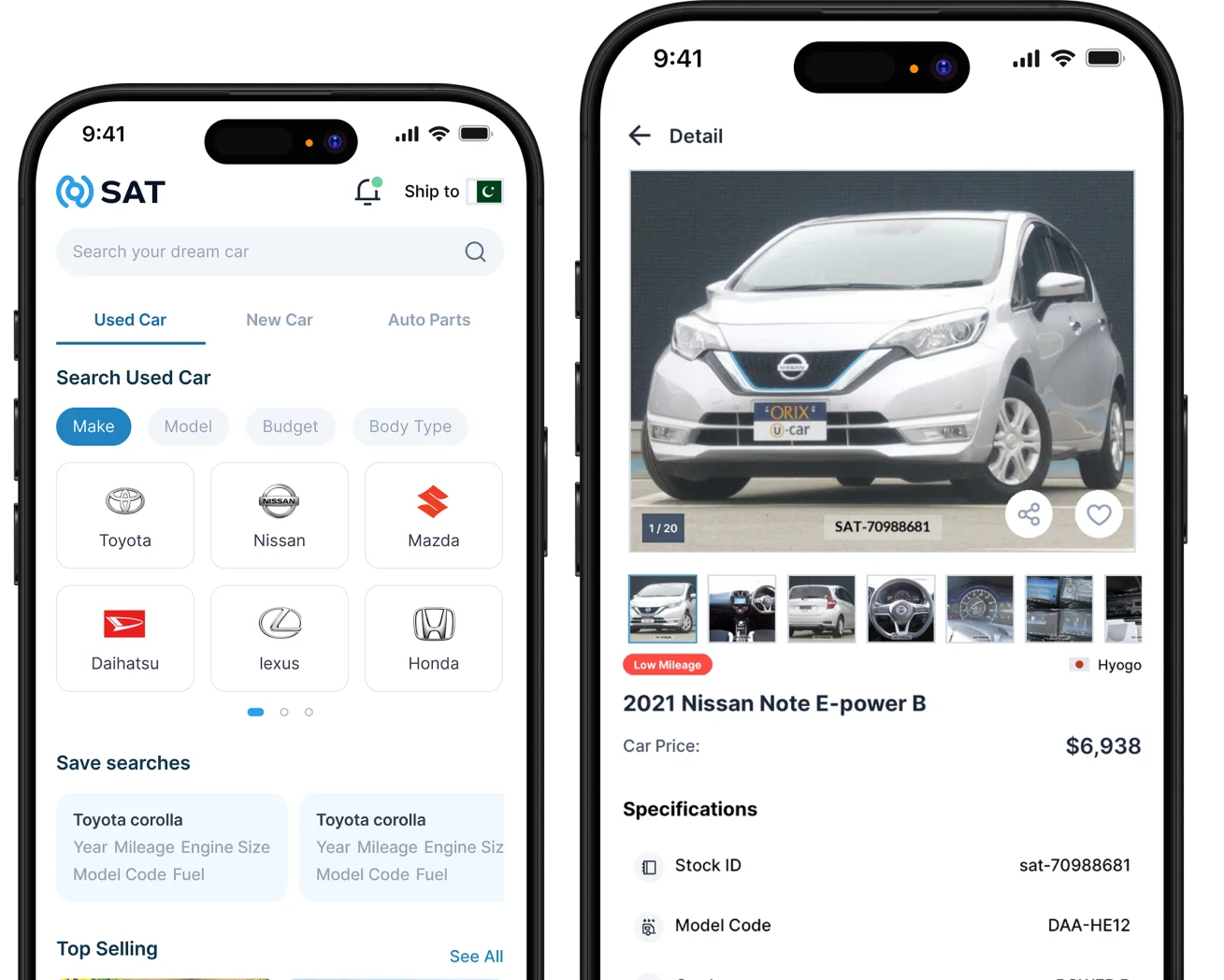

- Chunguza Kwa Mwaka 2000 - 2005 2005 - 2010 2010 - 2015 2015 - 2020 2020 - 2024

- Mahali pa Hisani Japani Tanzania Jamhuri ya Dominika Kenya Chile

- Makundi Mengine Dereva wa Mkono wa Kulia Dizeli Mafuta/ Petroli Umeme Mseto

Magari mapya

- Explore By Price Less than $1000 Between $1000 - $2000 Between $2000 - $3000 Between $3000 - $4000 Between $4000 - $5000 Above $5000

- Auto Parts Guide How to Buy Auto Parts How to Find the Model Code

USA

USA

Antigua

Antigua

Anguilla

Anguilla

Armenia

Armenia

Australia

Australia

Azerbaijan

Azerbaijan

Bahamas

Bahamas

Bangladesh

Bangladesh

Botswana

Botswana

Burundi

Burundi

Canada

Canada

Chile

Chile

Costa Rica

Costa Rica

Cyprus

Cyprus

Dominican Republic

Dominican Republic

Fiji

Fiji

Georgia

Georgia

Ghana

Ghana

Guatemala

Guatemala

Guyana

Guyana

Ireland

Ireland

Jamaica

Jamaica

Kenya

Kenya

Kyrgyzstan

Kyrgyzstan

Lesotho

Lesotho

Malawi

Malawi

Micronesia

Micronesia

Mongolia

Mongolia

Mozambique

Mozambique

Namibia

Namibia

New Zealand

New Zealand

Nigeria

Nigeria

Pakistan

Pakistan

Papua New Guinea

Papua New Guinea

Paraguay

Paraguay

DR Congo

DR Congo

Russia

Russia

Rwanda

Rwanda

Samoa

Samoa

Solomon Islands

Solomon Islands

Somalia

Somalia

South Africa

South Africa

South Sudan

South Sudan

Sri Lanka

Sri Lanka

Tanzania

Tanzania

Tonga

Tonga

Uganda

Uganda

Ukraine

Ukraine

Zambia

Zambia

Zimbabwe

Zimbabwe